Income Tax Thailand 2026 Modern Present Updated. Under the new guidelines, thais with foreign income will not be taxed if they remit that income in the year it was earned or the. Current tax laws and regulations, specifically section 41 of the thai revenue code and departmental instructions no.

Under revenue department order no. 161/2566, which took effect on january 1, 2024, thai tax residents must pay personal. Update learn how income tax for foreigners in thailand applies to foreign income under the new 2025 rules and proposed tax exemptions.

Source: www.konradlegal.com

Source: www.konradlegal.com

How to File Personal Tax in Thailand? Under revenue department order no. The government has set a target of 2.4 trillion baht ($70.6 billion) for fiscal year 2026, an increase of over 100 billion baht ($2.9 billion) from 2025’s target.

Source: www.hlbthai.com

Source: www.hlbthai.com

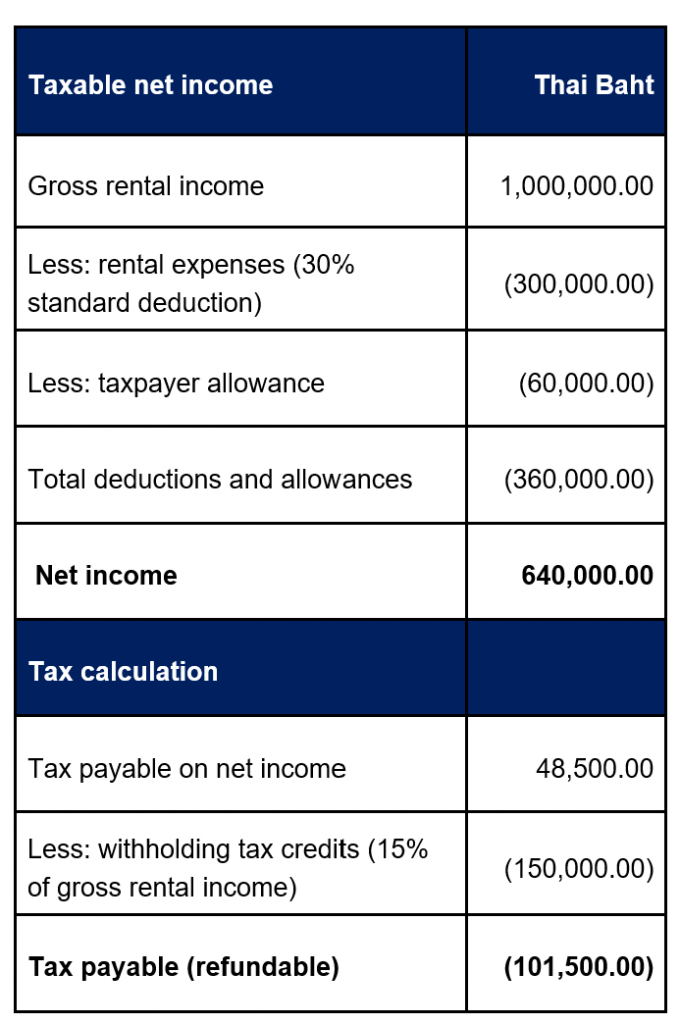

Thai rental properties and personal tax HLB Thailand Under revenue department order no. Current tax laws and regulations, specifically section 41 of the thai revenue code and departmental instructions no.

Source: www.runglobalpayroll.com

Source: www.runglobalpayroll.com

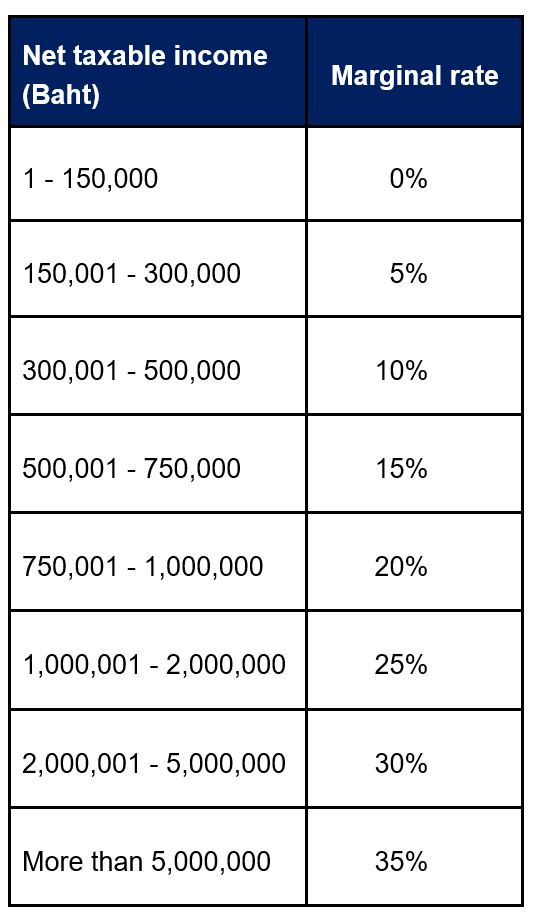

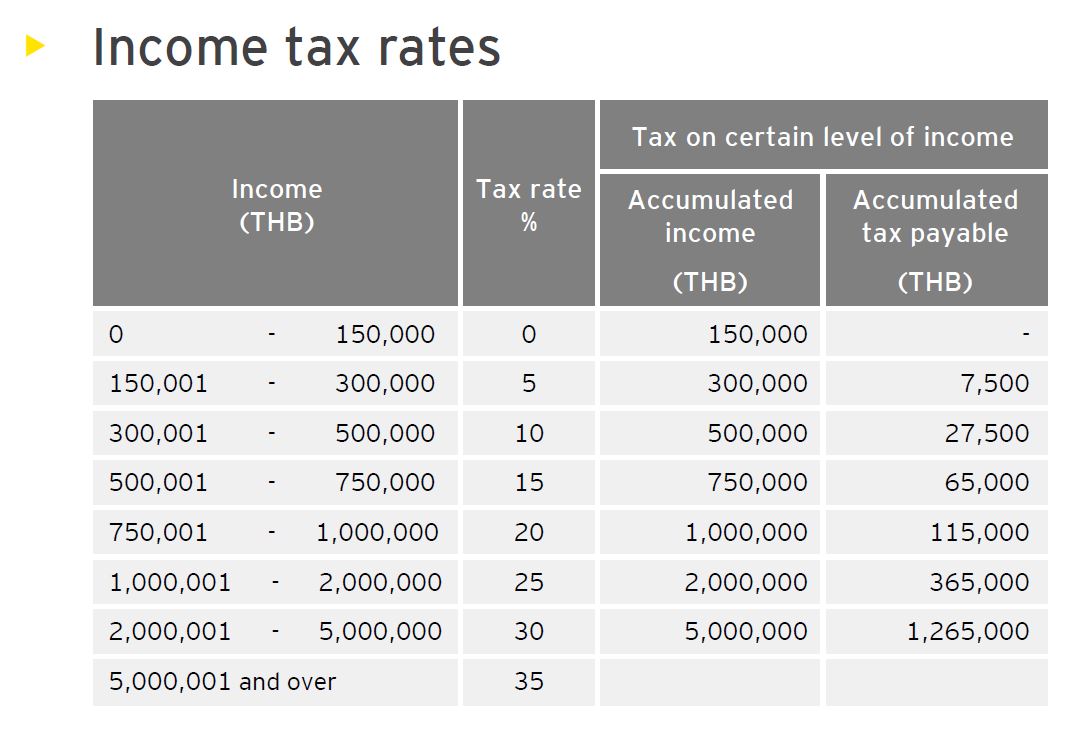

Payroll in Thailand Payroll Process and Payroll Taxes in Thailand Under the new guidelines, thais with foreign income will not be taxed if they remit that income in the year it was earned or the. Update learn how income tax for foreigners in thailand applies to foreign income under the new 2025 rules and proposed tax exemptions.

Source: ins-globalconsulting.com

Source: ins-globalconsulting.com

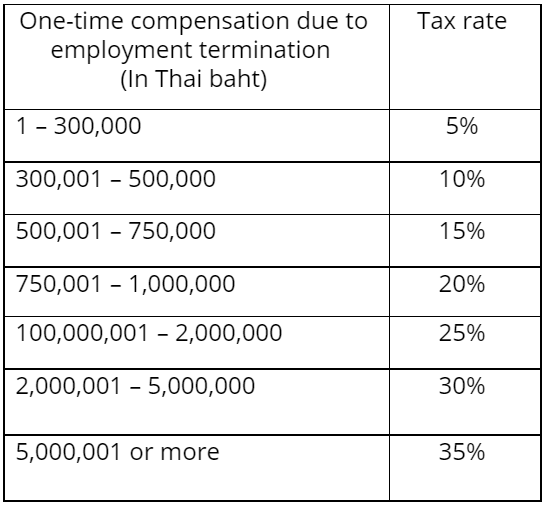

Severance Pay in Thailand An Essential Guide 🇹🇭 Under revenue department order no. Foreign income remitted in the same year earned or the following year (e.g., 2025 income brought in by.

Source: www.hlbthai.com

Source: www.hlbthai.com

Thai rental properties and personal tax HLB Thailand Under revenue department order no. Under the new guidelines, thais with foreign income will not be taxed if they remit that income in the year it was earned or the.

Source: www.jurajmicka.com

Source: www.jurajmicka.com

Thailand Tax Calculator 2020 (Download) For Thai Personal Tax Foreign income remitted in the same year earned or the following year (e.g., 2025 income brought in by. Update learn how income tax for foreigners in thailand applies to foreign income under the new 2025 rules and proposed tax exemptions.

Source: www.jurajmicka.com

Source: www.jurajmicka.com

Thailand Tax Calculator 2020 (Download) For Thai Personal Tax Foreign income remitted in the same year earned or the following year (e.g., 2025 income brought in by. Update learn how income tax for foreigners in thailand applies to foreign income under the new 2025 rules and proposed tax exemptions.

Source: scandasia.com

Source: scandasia.com

Tax payers in Thailand must include all transferred in their tax Under the new guidelines, thais with foreign income will not be taxed if they remit that income in the year it was earned or the. The government has set a target of 2.4 trillion baht ($70.6 billion) for fiscal year 2026, an increase of over 100 billion baht ($2.9 billion) from 2025’s target.

Source: insights.worldref.co

Source: insights.worldref.co

Mastering Tax in Thailand Your Essential Guide to Compliance Update learn how income tax for foreigners in thailand applies to foreign income under the new 2025 rules and proposed tax exemptions. 161/2566, which took effect on january 1, 2024, thai tax residents must pay personal.

Personal Tax of Thailand Withholding Tax Tax Deduction The government has set a target of 2.4 trillion baht ($70.6 billion) for fiscal year 2026, an increase of over 100 billion baht ($2.9 billion) from 2025’s target. 161/2566, which took effect on january 1, 2024, thai tax residents must pay personal.

Source: in.pinterest.com

Source: in.pinterest.com

Personal Tax in Thailand tax, tax return, Tax 161/2566, which took effect on january 1, 2024, thai tax residents must pay personal. Current tax laws and regulations, specifically section 41 of the thai revenue code and departmental instructions no.

Source: www.thai-property-group.com

Source: www.thai-property-group.com

Real estate taxation in Thailand Thai Property Group Foreign income remitted in the same year earned or the following year (e.g., 2025 income brought in by. 161/2566, which took effect on january 1, 2024, thai tax residents must pay personal.